The Ultimate Guide to Personal Loans: How to Secure Low Interest Rates in 2026

In today's fast-paced world, financial needs can arise unexpectedly. Whether it’s an unplanned medical emergency, a dream wedding, home renovation, or consolidating high-interest debt, a personal loan acts as a reliable financial safety net. Unlike specific-purpose loans like car or home loans, personal loans offer the flexibility to use the funds however you see fit.

However, navigating the world of lending can be overwhelming. With hundreds of banks, NBFCs (Non-Banking Financial Companies), and FinTech lenders competing for your attention, how do you choose the right one? In this comprehensive guide, we will break down everything you need to know about personal loans, from eligibility criteria to secrets for getting the lowest interest rates.

What is a Personal Loan?

A personal loan is an unsecured loan, meaning you do not need to provide collateral (like your house or car) to borrow money. Lenders provide these loans based on your creditworthiness, income stability, and repayment history. Because they are unsecured, they typically carry a slightly higher interest rate than secured loans but offer much faster processing times.

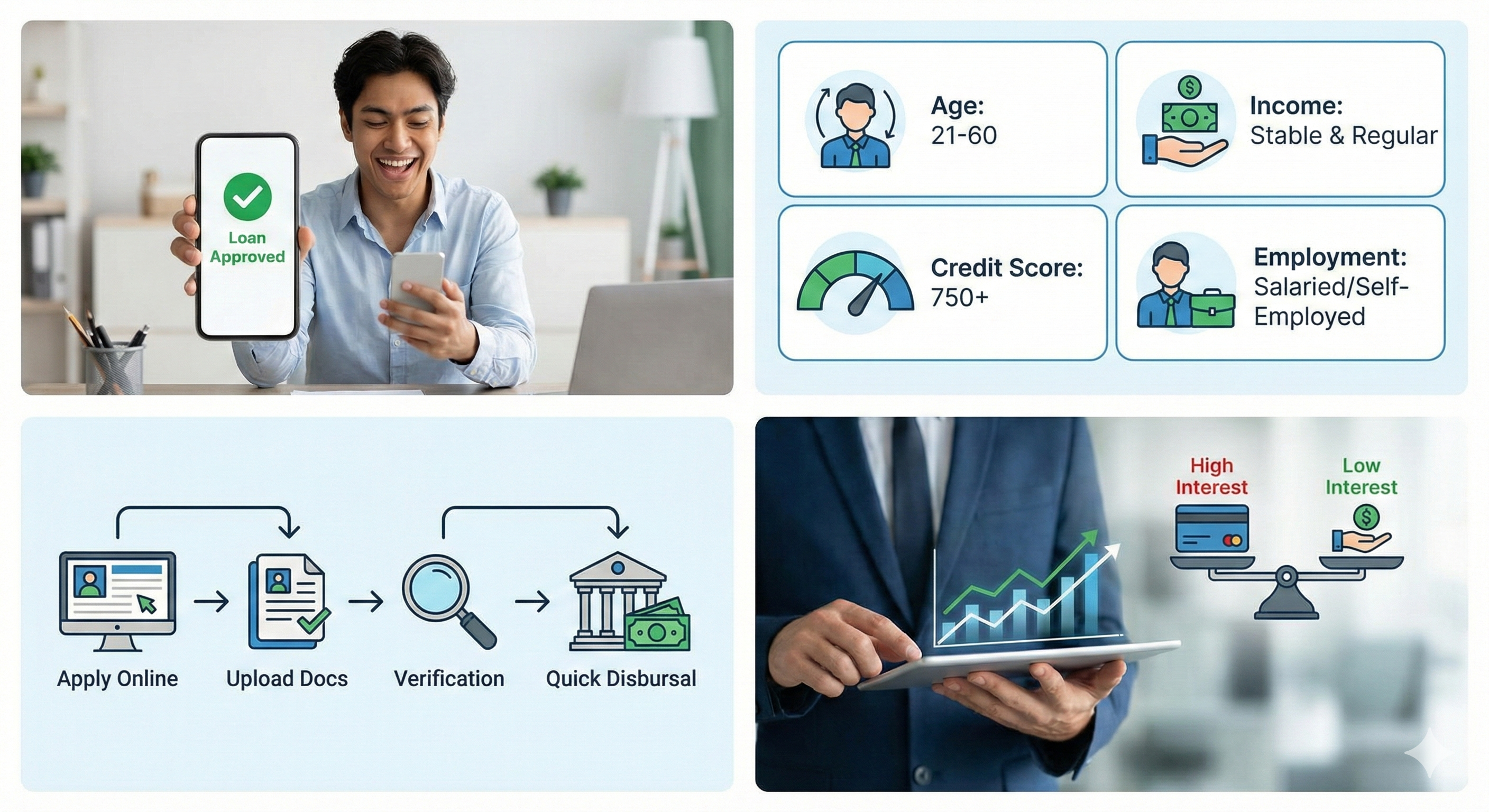

[Insert Image: "A professional individual smiling while looking at a 'Loan Approved' notification on a smartphone."]

Key Benefits of Taking a Personal Loan

- No Collateral Required: You don’t risk your assets to get the funds.

- Quick Disbursal: In 2026, many digital lenders offer "instant" personal loans where funds are credited within minutes.

- Minimal Documentation: If you have a good relationship with your bank, you might only need your PAN and Aadhaar.

- Versatile Use: From travel to education, there are no restrictions on how you spend the amount.

Eligibility Criteria: Who Can Apply?

While every lender has its own set of rules, the general eligibility criteria for a personal loan in 2026 include:

- Age: Usually between 21 and 60 years.

- Employment: You must be a salaried employee, a self-employed professional, or a business owner.

- Income: A minimum monthly income (usually starting from $1,500 or ₹25,000, depending on the region/city).

- Credit Score: A CIBIL or credit score of 750+ is ideal for low-interest offers.

- Work Experience: At least 1-2 years of total work experience and 6 months with the current employer.

[Insert Image: "Infographic showing icons for Age, Income, Credit Score, and Employment."]

Documents Required for a Smooth Application

To ensure your application is processed without delays, keep the following digital copies ready:

- Identity Proof: Passport, Voter ID, Aadhaar, or Driver’s License.

- Address Proof: Utility bills or Rent Agreement.

- Income Proof: Last 3 to 6 months' bank statements and salary slips.

- Tax Documents: Form 16 or Income Tax Returns (ITR) for the last 2 years.

How Interest Rates are Calculated

Interest rates are the most critical factor in your loan. They can be Fixed (stays the same) or Floating (changes with market rates). Lenders determine your rate based on:

1. Your Credit Score

Think of your credit score as your financial reputation. A high score tells the lender you are a low-risk borrower, allowing them to offer you "Prime" interest rates.

2. Debt-to-Income Ratio

Lenders look at how much of your monthly income goes toward existing EMIs. If you are already paying off multiple loans, they may charge a higher rate or reject the application.

3. Employer’s Reputation

If you work for a Fortune 500 company or a government entity, lenders consider your job "secure," which often leads to discounted rates.

[Insert Image: "Flowchart showing the steps from Online Application to Cash in Bank."]

Step-by-Step Process to Apply Online

Applying for a personal loan has never been easier. Follow these steps for a 100% digital experience:

- Check Your Credit Score: Use a free tool to see where you stand. If it’s below 700, try to improve it before applying.

- Compare Lenders: Don't settle for the first offer. Compare interest rates, processing fees, and foreclosure charges.

- Fill out the Application: Provide your personal and professional details on the lender's website or app.

- Upload Documents: Use clear scans of your KYC and income documents.

- Verification: The lender will verify your details through a physical visit or E-KYC (Video KYC).

- Approval and Disbursal: Once approved, sign the loan agreement digitally, and the money will be transferred to your account.

Common Mistakes to Avoid

Many borrowers make mistakes that cost them thousands in extra interest. Avoid these:

- Applying at Multiple Banks Simultaneously: Each application triggers a "Hard Inquiry," which can drop your credit score.

- Ignoring the Fine Print: Always check for hidden charges like "Processing Fees," "Pre-payment Penalties," and "Late Payment Charges."

- Borrowing More Than Needed: Just because you are eligible for a $50,000 loan doesn't mean you should take it. Only borrow what you can comfortably repay.

[Insert Image: "Graphic comparing Personal Loans vs. Credit Cards for big purchases."]

Frequently Asked Questions (FAQs)

1. Can I get a personal loan with a low credit score?

Yes, but the interest rates will be significantly higher, and you might need a co-applicant or guarantor.

2. How long does the disbursal take?

In 2026, many FinTech lenders disburse loans within 2 to 24 hours. Traditional banks may take 2-3 business days.

3. Is there a penalty for paying off the loan early?

Most lenders charge a foreclosure fee ranging from 2% to 5% of the outstanding balance. However, some lenders offer zero-foreclosure charges after a certain period.

Conclusion

A personal loan is a powerful financial tool when used responsibly. By maintaining a high credit score, comparing different lenders, and reading the terms carefully, you can secure a loan that helps you achieve your goals without breaking the bank. Always ensure you have a repayment plan in place before hitting that 'Apply' button.

Ready to find the best rates? Start your application today and take the first step toward financial freedom!